Ottobock's Failed Acquisition Of Freedom Innovations: Hans Georg Näder's Dubious Decision-Making Costs Ottobock Dearly

Ottobock SE & Co. KGaA (Ottobock) owner Hans Georg Näder (Näder) was called a “tyrant” during the course of hearings related to an illegal 2017 acquisition of a US industry competitor that forced US regulators to order Ottobock to divest all assets it acquired and costing the company 78.1 million Euros, with US regulators raising alarm over Ottobock’s product quality.

Former Freedom Innovations (Freedom) CEO David Smith (Smith) criticised Näder and his temperament during his testimony in court over Ottobock’s unsuccessful acquisition of Freedom, which was aimed at squashing Ottobock’s technologically superior competitor.

Records confirm a widely known secret within the industry and among regulators that Ottobock’s product quality is sub-par and the company is failing to abide by basic business standards. Ottobock never sought regulatory approval for purchasing Freedom, with the US Federal Trade Commission (FTC) learning of the merger after its completion and forbidding it retroactively. The company is only able to maintain a market share thanks to a monopolistic expansion strategy which runs afoul of anti-trust regulations, all at the expense of disabled customers.

These revelations, based on legal filings extracted from Ottobock’s litigation with the FTC, are a warning sign to potential investors of Ottobock amid the company’s planned initial public offering (IPO) on the Frankfurt Stock Exchange in 2022, raising concerns about Näder’s intransigence, lack of foresight and iron grip on Ottobock’s daily operations that have resulted in its abusive approach to the global prosthetic market.

Ottobock runs afoul of US anti-competition laws in poorly-conceived acquisition plan

On 22 September 2017, Ottobock acquired Freedom, the third-largest US prosthetic limb manufacturer and one of the German healthcare group’s closest American competitors, for some USD 72 million. In December of the same year, the FTC launched an administrative complaint to block the acquisition on anti-trust grounds. The FTC deemed the merger anti-competitive as it would have resulted in Ottobock’s US market share rise to 80%, an increase that authorities deemed “presumptively unlawful” by eliminating close competition between Ottobock and Freedom’s prosthetic limb products.

According to legal filings, the FTC only began its investigation “after the acquisition had closed” as Ottobock failed to seek premerger approval from the FTC for the Freedom acquisition, violating US anti-trust regulations and contradicting an Ottobock press release in September 2017 stating that “all anti-trust issues have already been clarified.”

Following a lengthy appeals process launched by Ottobock in May 2019, the FTC ruled in November of the same year that Ottobock’s acquisition of Freedom violated anti-trust laws and ordered the acquisition’s unwinding. Ottobock finally completed the sale of a significant portion of Freedom’s assets to French prostheses manufacturer Proteor SA in December 2020.

Court filings also indicate that FTC employees labelled Ottobock’s legal defence as a “kitchen-sink” approach, a quip emphasising Ottobock’s incoherency and factual analysis, and sarcastically thanked Ottobock for handing the FTC victory in the case. Ultimately, the German prostheses maker failed to convince the FTC that the merger did not substantially affect competition in the US market.

Throughout this period, direct contact between Freedom and Ottobock was legally prohibited and Ottobock was unable to consolidate any Freedom assets, meaning that the German manufacturer took on the costs of managing Freedom while being barred from any traditional associated benefits. The damages to the company may run into the hundreds of millions of euros.

Inferior product quality a factor in Ottobock’s failed attempt to acquire Freedom

According to the FTC, Ottobock’s acquisition of Freedom marked an attempt to eliminate competition between Ottobock’s C-Leg and Freedom’s Plié microprocessor knees (MPKs), the companies’ respective flagship products. This battle had benefitted amputees by fostering price and innovation competition which had seen the companies compete for the same target audience and clientele.

The launch of Freedom’s new-generation Plié 3 leg in 2014, whose average price was set lower than the C-Leg, was perceived by Ottobock as a “direct and serious competitive threat” which led to a decrease in sales for the German manufacturer. Ottobock’s C-Leg 4, which was launched in 2015 as a response to Freedom’s Plié 3, was technologically inferior and suffered numerous defects, stated Freedom chairman Maynard Carkhuff during an FTC interview:

Ottobock’s inferior product quality, which was reported widely among its industry competitors, may have been a key motivational in its desire to buy Freedom. Ottobock’s actions thus constituted an attempt to remove “from the market a maverick firm that had competed against Ottobock … by offering low prices” and endangering Ottobock’s dominant US market position, according to the FTC.

The rot starts with “tyrant” Näder

The FTC’s intervention in the Ottobock-Freedom takeover reflects poorly both on the German company and its majority shareholder Näder. The flamboyant businessman, who intends to keep an iron grip over Ottobock’s strategic direction and orientation by keeping a controlling stake in the group post-IPO, has been described by a former close consultant as “not easy to deal with and particularly resistant to advice…You can’t manage someone like him.”

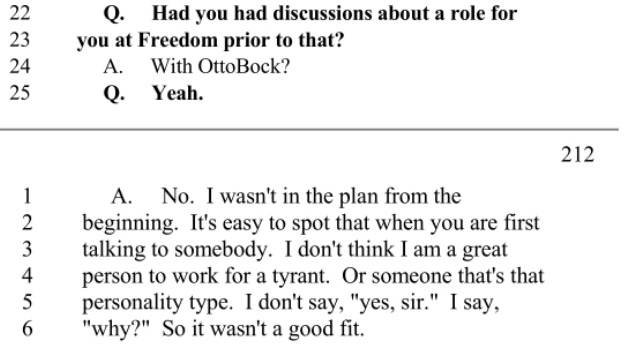

Former Freedom Innovations CEO David Smith, who confirmed that Ottobock intended to shut Freedom down after acquiring it, also minced no words during in-person testimony to the FTC when describing Näder:

“I don’t think I am a great person to work for a tyrant,” said Smith in reference to Näder. “Or someone that’s that personality type. I don’t say, ”yes, sir.” I say, “why?” So it wasn’t a good fit.”

“They had a very strong authoritarian personality,” he added.

Ottobock-Freedom saga damaging to the German company’s IPO aspirations

Damages to Ottobock arising from its failed acquisition of Freedom Innovations may have run into the hundreds of millions. The company has already written off the full USD 72 million paid for Freedom in September 2017, German media reports quickly removed by Näder’s lawyers noted that Ottobock’s 2017 financial reporting disguised a EUR 168 million loss for the year and the FTC ruling forced Otto Bock to divest from Freedom with no minimum price limit.

The blocked Freedom acquisition is merely one symptom of Ottobock’s stagnated economic performance and Näder’s totalitarian-like approach to corporate governance. Worryingly for investors, this entrenched hierarchy is unlikely to be incentivised to reform given that the Näder family intends to keep some 70% of Ottobock in their hands post-IPO, according to various German news reports.

Näder’s repeated equity withdrawals from Ottobock - Nader has withdrawn “around half a billion euros” from the group in the last decade to fund his lavish personal lifestyle and other spontaneous, poorly thought-out ventures - have also done nothing to allay investors’ concerns that “if the share of equity is getting smaller and smaller, the company will eventually stand on very shaky legs.”

Despite this, Ottobock CEO Phillippe Schulte-Noelle, the nominal head of the group, said in a December 2021 interview that he agrees with Näder “in almost all cases,” reaffirming the majority shareholder’s operational control and Schulte-Noelle’s role as Näder’s puppet. Undoubtedly, the Näder family will retain dominant influence over the healthcare group’s investment strategy and strategic development. Their disastrous decision-making during the Ottobock-Freedom saga, however, makes grim reading for “tyrant” Näder and Ottobock’s IPO prospects.

Full Documents

The full documents related to the case are available here: 1, 2, 3, 4