By Jan Dams, Welt am Sonntag, 05.10.2025. Original article here.

YACHTS, TAXES AND SANCTIONS

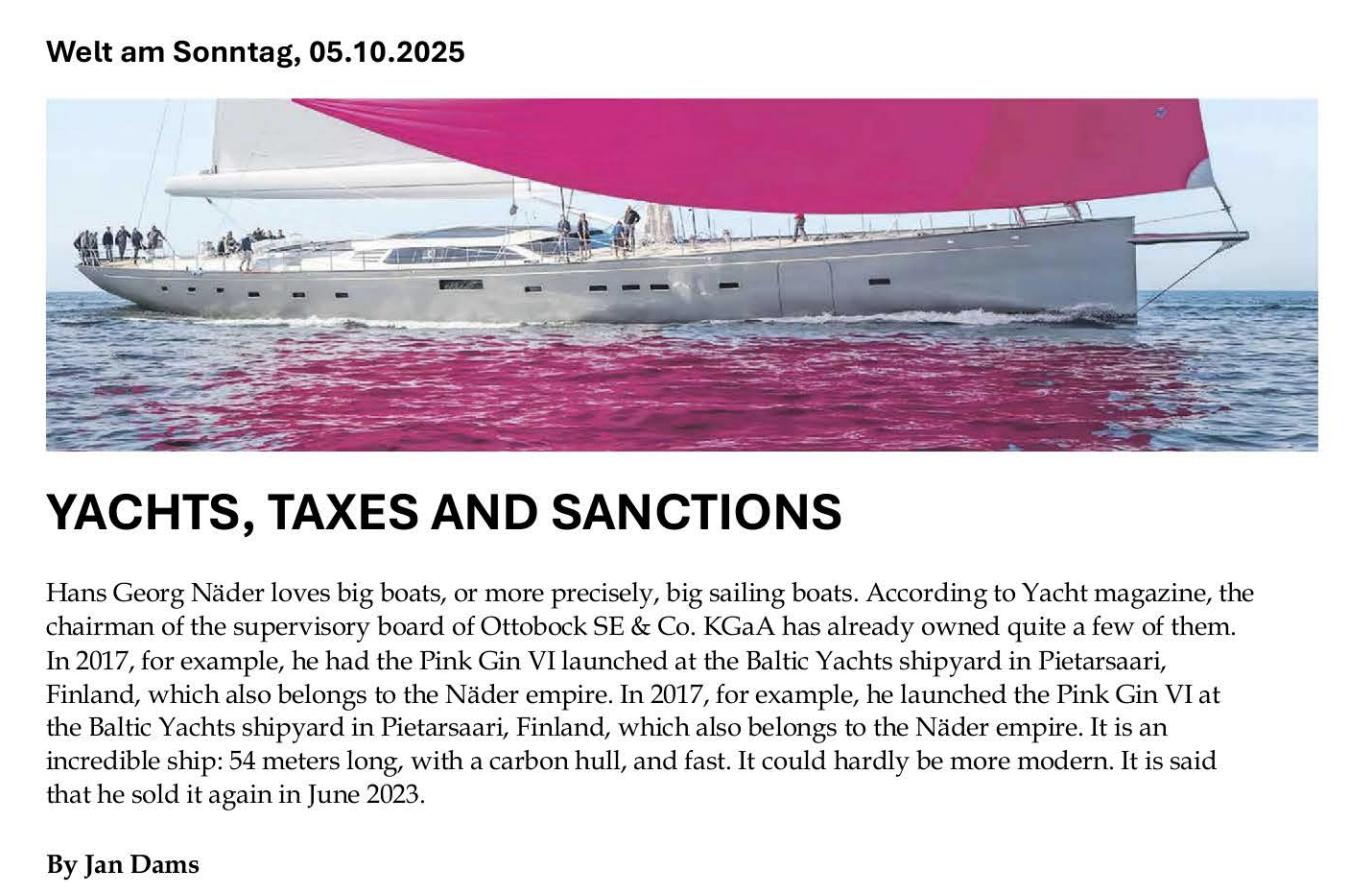

Hans Georg Nader loves big boats, or more precisely, big sailing boats. According to Yacht magazine, the chairman of the supervisory board of Ottobock SE & Co. KGaA has already owned quite a few of them. In 2017, for example, he had the Pink Gin VI launched at the Baltic Yachts shipyard in Pietarsaari, Finland, which also belongs to the Nader empire. It is an incredible ship: 54 meters long, with a carbon hull, and fast. It could hardly be more modern. It is said that he sold it again in June 2023.

However, Nader’s passionate love of sailing boats is the subject of an investigation by the public prosecutor’s office in Braunschweig. The investigation concerns suspicions of “serious evasion of German sales tax.” The investigation relates to the purchase of two ships by Nader, or rather a company controlled by him, and is not connected with Ottobock.

This is stated on page 225 of the 644-page prospectus for the IPO of Ottobock SE. Nader wants to float the company on the stock exchange on Thursday. Bad news does not fit into the picture. After all, Nader is the owner and chairman of the supervisory board and thus the head behind Ottobock.

If he is convicted at the end of the investigation, the question arises as to whether he can remain chief supervisor. It is of little help that Nader insists he “has been advised that he acted in accordance with the applicable German sales tax regulations and intends to continue to defend himself vigorously against the allegations,” according to the prospectus. When asked, Ottobock simply states: “This is a private matter concerning Mr. Nader that has nothing to do w ith the company.”

BUSINESS IN RUSSIA

However, the allegations come as no surprise. In 2017, WELT AM SONNTAG reported that Nader had allegedly used the tax haven of Malta to operate his yacht “Pink Gin VI” under the registration number C49990 as Pink Gin Ltd. - with the result that he paid less VAT. A company spokesperson said at the time that this arrangement was legal, transparent, and known to the German tax authorities.

“What’s wrong with saving tax on a ship registered in Malta in order to use it in another, more meaningful place?” An Otto bock spokesperson did not want to comment on whether the current investigations also concern the “Pink Gin VI.”

An IPO prospectus often reveals more about the pitfalls of a business than other documents. This is because, in addition to tax investigations, there are other risks: Ottobock SE, known for its high-tech prostheses, continues to operate in Russia despite sanctions. The artificial intelligence ChatGPT counts the word Russia 186 times in the IPO prospectus. The importance of the Russian market has even increased. In 2022, the year of the invasion of Ukraine, Ottobock SE generated 5.6 percent of its revenue in Vladimir Putin’s empire. A year later, that share fell to five percent. Then, in 2024, there was a turnaround: 6.8 percent of revenues came from Russia, and in the first half of 2025, the figure was as high as 8.8 percent.

So at a time when other German companies were scaling back their activities, Ottobock’s grew - and at a faster rate than the group as a whole. Between 2022 and 2024, sales rose from €74.7 million to a good €109 million. In the first six months of this year, it was already over 70 million euros. When asked, Ottobock attributed this to exchange rate effects and divestrnents, among other things.

VIOLATION OF SANCTIONS

Ottobock is aware that its success in Russia comes with risks, including to its reputation. “Laws, regulations, or licensing policies relating to economic sanctions or export controls could change, and additional countries could introduce economic sanctions, export controls, or similar regulations that could adversely affect our business, exports, or sales in these or other countries, or could result in restrictions, penalties, or fines,” the company states. A violation of applicable or future laws could result in civil or criminal liability, as well as negative publicity or damage to reputation.

The company justifies its commitment with humanitarian exemptions and the safeguarding of medical care. Ottobock does not supply products to clinics and workshops “associated with the military, paramilitary organizations, the police, or intelligence services.” It limits itself to tenders for the provision of medical products for the civilian population. In its own facilities, ‘‘we supply civilian users of prostheses with our own specialist staff."

Can this be guaranteed? Probably not. Ottobock does not rule out the possibility that the products may end up in the hands of injured soldiers. In addition, the company admits to a violation of sanctions: between November 2023 and May 2024, three deliveries of a wheelchair leveling device were made without the approval of the export authority (Bafa) as a result of a change in EU regulations. Ottobock reported the error itself. So, is this not a big problem, assuming that the company would have received the export license anyway?

Perhaps. However, the incident shows how difficult business with sanctioned countries can be.

Nevertheless, the IPO does not appear to be a high-risk venture for investors. Ottobock is the market leader in its sector. Analysts expect continued strong sales growth. The price range for the shares is between €62 and €64. This would give the company a market capitalization of between €4 billion and €4.2 billion, significantly below the €6 billion previously reported. If the shares were allocated at the upper end of the price range, the proceeds would be around 673 million euros. However, only just under 100 million euros of this would go to the company. The rest would go to the Nader family. In March 2024, they bought back 20 percent of Ottobock shares from the private equity firm EQT.

Now, according to reports, Nader has to refinance the price. That’s why he needs money, according to observers.

However, the future shareholders are uncomfortable with Ottobock. Unlike the general partner, they do not have much power in their investment due to the legal form of the KGaA. The fan of expensive yachts can thus continue to rule largely undisturbed.