Part 1: Ottobock Financial Analysis (HGB) Based on publications in the German Federal Gazette 2018 - 2023 and the current debt situation disclosed in the IPO prospectus dated September 29, 2025

Ottobock’s Financial Position and Earnings before of the IPO

“Numbers don’t lie” as the old saying goes especially not when certified Ьу auditors.

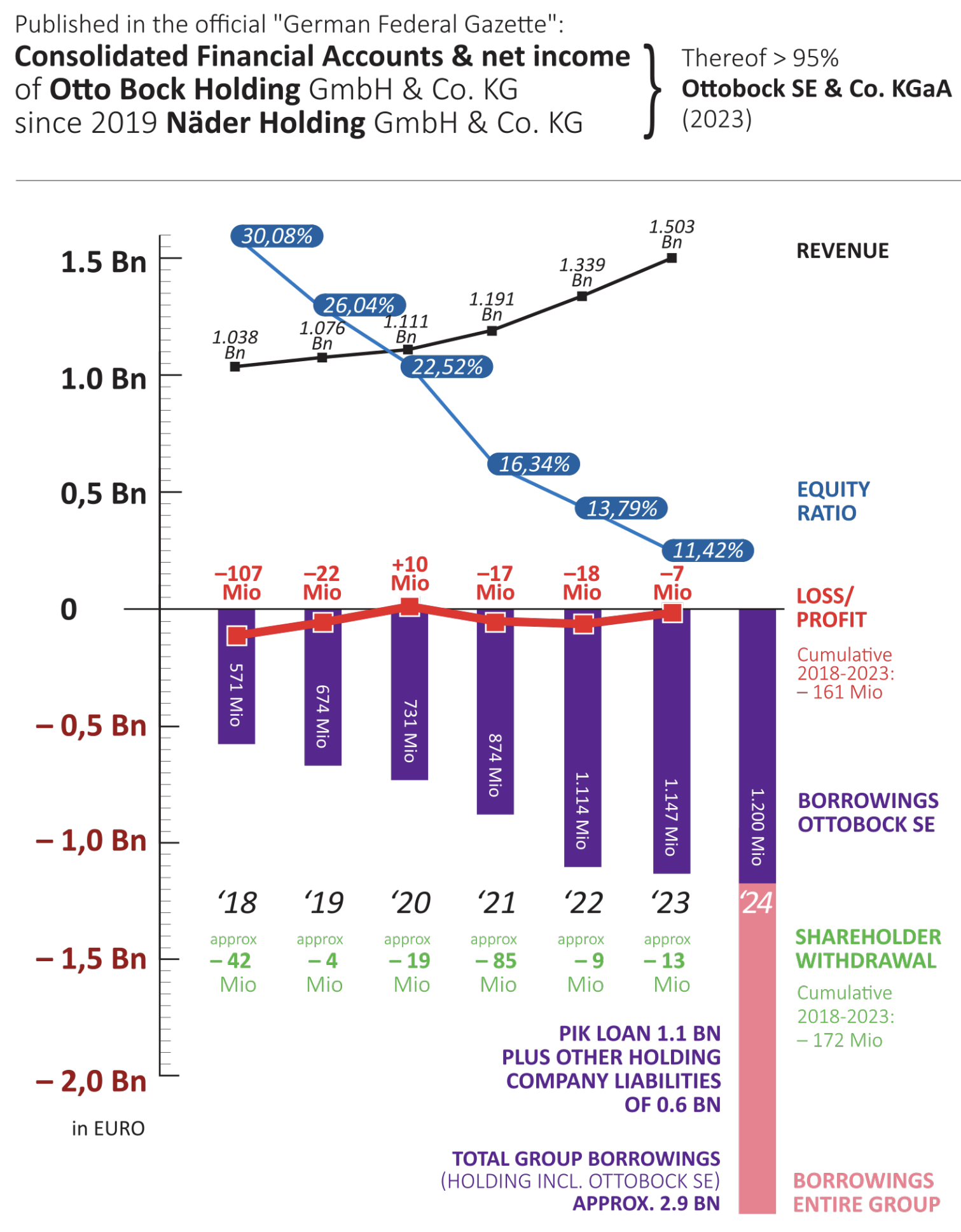

The true picture emerges from the financial statements and annual results filed Ьу today’s Nader Holding GmbH & Со. KG (formerly Otto Bock Holding GmbH & Со. KG) in the German Federal Gazette. These filings represent more than 95% of the business that is now being floated as Ottobock SE & Со. KGaA.

In its external communications, Ottobock has consistently highlighted only “underlying adjusted EBITDA” а figure maximally “optimized” bу applying virtually every conceivable accounting adjustment.

Actual net income figures, however, long hidden from disclosures in their presscommunications tel1 а different story. Over time, however, they reveal the company’s real financial condition - numbers investors can verify transparently in the mandatory publications of the German Federal Gazette.

Key Findings

-

Based on EQT’s sale of its 20% stake in Otto bock SE for €579 million in March 2024, the company’s equity value accepted by EQT was around €2.8 billion.

-

To repurchase EQT’s 20% stake, Nader Holding took out a PIK loan of €1.1 billion, accumulating an interest rate of 13% per annum.

-

Meanwhile, Ottobock SE itself doubled its debt between 2018 and 2023 to around €1.2 billion.

-

Of the IPO proceeds, just €100 million will be raised for the company itself through a capital increase “for growth financing” However, significant portions of the proceeds will be absorbed by IPO costs.

-

The bulk of the IPO proceeds - about €700 million - will flow directly to Hans-Georg Nader respectively his Nader Holding, to service its additional debt burden at holding company level.

-

In addition to the PIK loan of €1.1 billion, Nader Holding has other contractual obligations/liabilities of about €600 million.

>> Total holding company debt: ~€1.7 billion -

Including the PIK loan, the group’s consolidated debt (Holding + Ottobock SE) has increased fivefold to some €2.9 billion during the analyzed timeframe.

-

The IPO proceeds flowing mainly into the holding company will fall far short of repaying these existing obligations.

-

According to the IPO prospectus (page 34), even after IPO inflows, the holding company will still face €1.02 billion of outstanding debt.

-

This means Hans-Georg Nader, respectively his holding company, will need to sell additional shares worth ~€1 billion over time - creating sustained selling pressure on the stock.

-

The IPO lock-up period for Nader’s share disposals is set at an unusually short 6 months and can even be lifted earlier by the underwriting syndicate.

Collateralization of the PIK Loan

-

To secure the PIK loan, Nader Holding pledged all of its Ottobock SE shares to the loan consortium.

-

While the loan matures in March 2030, it will immediately be called if Nader Holding’s stake in Ottobock SE falls below 60%.

-

The same applies if Nader Holding were to lose control of Ottobock SE or if the legal structure of the partnership limited by shares (KGaA) were altered or if the SE changes its legal form for instance into an AG.

(Here, prospectus disclosures on page 225 may be of particular relevance.)

Earnings Power is Negative

-

The group, of which Otto bock SE makes up more than 95%, reported a positive net profit in only 1 out of the past 6 years.

-

Over the same period, losses amounted to €161 million cumulatively.

-

At the same time, the Naders have withdrawn large sums from the company every year. Between 2018 and 2023, this amounted to € 172 million.

-

The equity ratio fell from around 30 per cent to around 11 per cent between 2018 and 2023.

-

Sales grew by approximately 7.6 per cent per annum between 2018 and 2023, driven largely by numerous small acquisitions.

-

Before Russia’s attack on Ukraine and the resulting economic boom for Ottobock - the company supplies the armies on both sides - annualized growth, including smaller acquisitions, was only 4.7 per cent (2018 - 2021).

-

These figures show the great importance of the war and business with Russia for Ottobock’s growth.

Part 2: Current Ottobock Earnings (IFRS) and Target Valuation based on company disclosures and IPO prospectus dated September 29, 2025

For the first time, Ottobock SE disclosed IFRS-based net income figures:

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Profit for the year | € 48,1 Mio | € 27,9 Mio | € 28,0 Mio |

| Total comprehensive income for the year, net of tax * |

€ 17,7 Mio | € 26,8 Mio | € 2,6 Mio |

| Profit per Share ** | € 0,76 | € 0,47 | € 0,47 |

* after currency effects

** Number of shares on the issue date

IPO Mechanics

-

Capital increase: 1,612,903 new shares to be issued.

-

Additionally, Nader Holding will sell 9,125,000 existing shares.

-

Further 1,610,685 existing Nader shares may be lent out via a Greenshoe option, used for stock price support during the first 30 days after trading start.

Post-IPO, the company will have 64,087,903 shares outstanding.

Valuation Targets

At a mid-range placement price of €64 per share, Ottobock targets an implied market capitalization of some €4.1 billion. However, based on trailing average earnings as disclosed in the IPO prospectus, (see table above) this implies a price-earnings (P /E) ratio of more than 100.

For comparison, the main peer Ossur / Embla Medical - a smaller company, but with higher net profits and far lower debt burden - currently trades at a trailing P /E of 29.

Investor Takeaway

Ottobock faces serious structural weaknesses:

- High leverage

- Low profitability

- Declining equity ratio

- Fragile growth drivers

These factors raise significant concerns about the sustainability of the business model ahead of the IPO.

FAQ and further Articles from the Web:

Find relevant articles in the press overview:

👉 Handelsblatt: These are the critical points of the Ottobock IPO

👉 The Market: Ottobock IPO: cheap in distress sale by colourful owner

👉 Bloomberg: Prosthetics manufacturer Ottobock aims for €4.2 billion market capitalisation in Frankfurt IPO

👉 Finanzen.net: Ottobock shares: Price range for IPO announced