Ottobock Share (OBCK) -- FAQ on IPO, Valuation, and Key Risks

How has the Ottobock share (OBCK) performed and why did the IPO require GreenShoe stabilization?

Ottobock’s share (OBCK) was issued at approximately €28 per share. Shortly after listing, the stock showed volatile performance, prompting the use of a so-called GreenShoe mechanism to stabilize trading.

Under this mechanism, the lead underwriter may repurchase shares to support the market price. Such intervention typically signals limited investor confidence in sustained demand. Once the stabilization phase expires, the stock may face renewed downward pressure. A detailed analysis is available at https://naeder.by/ipo/.

What is Ottobock’s P/E ratio (KGV), and how does it compare to peers like Össur or Smith & Nephew?

Ottobock’s current price-to-earnings ratio (P/E) stands at around 145, far above the industry average. Competitors such as Össur (P/E 35) and Smith & Nephew (P/E 27) trade on the basis of solid profits, while Ottobock’s valuation largely reflects expectations of future growth.

Given moderate margins and high leverage, this valuation appears highly ambitious. Investors should assess whether earnings performance can justify the current multiple. Ottobock ranks within the top 2 % quantile of valuation multiples among large German corporates—without exhibiting the growth profile or high-margin software assets that would normally warrant such a premium.

Fundamental Valuation Overview Market Capitalization: ~ € 4.4 bn Revenue (2023): ~ € 1.2 bn EBITDA (2023): ~ € 190 m EV/EBITDA: ≈ 23× (vs. MedTech peer average of 12–15×) Debt: High, including a ~ € 1 bn PIK loan linked to H. G. Näder

Valuation Risks & Investor Implications

Expectation Gap: The market prices in growth Ottobock has yet to deliver (organic growth < 5 %).

Peer Comparison:

Even quality MedTech names such as Siemens Healthineers (P/E 24×) trade at roughly one-sixth of Ottobock’s multiple.

Cashflow Yield:

Below 1 %, indicating a narrative-driven rather than cashflow-based valuation.

Free Float:

Low – leading to limited liquidity and dependence on active price support, including GreenShoe operations.

Investor View:

Ottobock appears significantly overvalued versus the DAX-40 benchmark.

The market treats it like a high-growth MedTech start-up, though financials resemble a mid-sized industrial company with modest margins.

Institutional investors would typically:

- classify a P/E > 100 as clearly excessive,

- expect multiple compression toward 25–35× (comparable to Healthineers/Beiersdorf),

- and estimate a fair enterprise value in the range of € 1.2–1.6 bn, depending on growth assumptions.

Is the Ottobock share (OBCK) fairly valued given its debt load and Russia exposure?

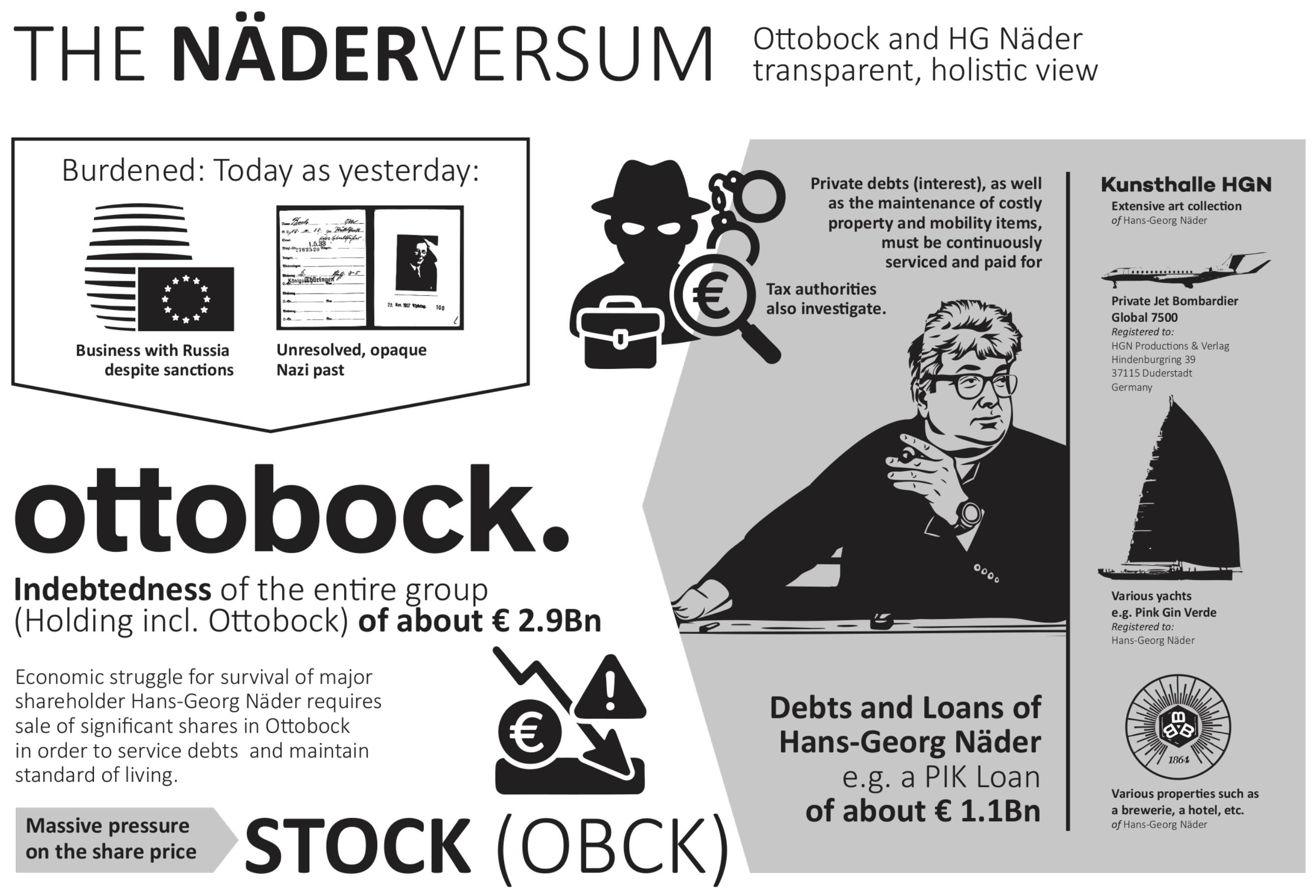

Ottobock carries substantial net debt, driven partly by acquisitions and intra-group financing. This structure increases interest costs in today’s higher-rate environment. Moreover, its dependence on the Russian market adds geopolitical and regulatory risk. Both factors challenge the sustainability of the current market valuation and may constrain future dividends.

What happens to Ottobock’s and H. G. Näder’s debts?

A significant portion of Ottobock’s debt is indirectly tied to the holding structure of majority shareholder Hans Georg Näder. His investment vehicles hold Ottobock stakes financed through loans and PIK instruments. Failure to service these could trigger forced equity sales, potentially weighing heavily on the OBCK share price and investor confidence.

What should institutional investors know about Ottobock that’s not in the IPO prospectus?

Beyond headline figures, investors should consider the opaque interlinkages between corporate and private financing structures, dependence on subsidies, export markets, and orthopedic aid segments, and limited comparability of adjusted profit metrics (EBITDA adjustments). These factors raise Ottobock’s valuation risk versus transparent, consistently profitable peers such as Össur.

What financial and geopolitical risks are embedded in Ottobock’s stock?

The key risks include high leverage and a P/E exceeding 100, geopolitical exposure (notably Russia and Asia), supply-chain vulnerabilities, and regulatory uncertainty under EU and U.S. FDA MedTech frameworks. Even modest revenue declines or currency effects could significantly affect profitability - Ottobock has reported only one year of positive operating profit in recent periods.

What happens if H. G. Näder fails to service the PIK loan – and what would be the impact on Ottobock and the share price?

Should Näder default on PIK loan interest, restructuring or partial divestment of his Ottobock stake may become necessary. While this could raise the free float, it would likely pressure the share price if markets interpret the move as a loss of confidence in the ownership structure. Such a development would serve as a red flag for institutional investors, indicating financial instability behind the scenes.

What is a GreenShoe mechanism – and why was it used for the Ottobock share (OBCK)? The GreenShoe mechanism is a standard IPO price-stabilization tool allowing underwriters to buy or sell up to 15 % additional shares to support early trading.

For Ottobock, this mechanism was managed by BNP Paribas, Deutsche Bank and Goldman Sachs as Joint Global Coordinators and Bookrunners, alongside Bank of America Securities, Jefferies, UniCredit, and UBS. Commerzbank, DZ Bank, and LBBW acted as Senior and Co-Lead Managers.

The tool was activated because post-IPO demand proved insufficient to maintain the issue price—an essential condition for further share sales needed to service Ottobock’s high liabilities.

While the GreenShoe can instill short-term confidence, active intervention often indicates weak market appetite or overvaluation. Once the stabilization period ends, the share price may come under pressure if real investor demand is lacking. Investors should clearly differentiate between technical price support and genuine market conviction.

Who is Hans Georg Näder?

Hans Georg Näder is an entrepreneur from Germany and is the third generation CEO of the Otto Bock Group.

How old is Hans Georg Näder?

Hans Georg Näder was born on September 4, 1961 and is 61 years old.

Where was Hans Georg Näder born?

Näder was born in Duderstadt, where he also spent his youth and graduated from high school.

What did Näder study?

Näder studied business administration at the University of Nuremberg/Erlangen. He completed his studies at the age of 28.

How long has Näder been Managing Director of the Otto Bock Group?

Hans Georg Näder took over the company from his father Max Näder when he was just 28 years old. He is now the third generation to manage the company.

Does Näder have any children?

Hans Georg Näder has two daughters. Both his younger daughter Georgina Näder and her older sister Julia Näder are part of the family business.

Is Näder married?

The planned wedding in 2018 with his girlfriend at the time, Nathalie Scheil, did not materialize. Shortly before the wedding, the couple separated. His two daughters are from his two previous marriages. Bild 7 February 2018

Where does Näder live?

Näder has lived in Berlin for over 20 years. Hans Goerg Näder was born in Duderstadt.

Who founded Eichsfeld Air?

In 2004, Hans Georg Näder, a German entrepreneur and CEO of the Otto Bock group of companies, founded the airline. Its headquarters are located in Duderstadt. However, the company uses the airport in Günterode/Heiligenstadt, which is only a few kilometers away.

Is Hans Georg Näder a professor?

Näder has been an honorary professor of entrepreneurship and business administration at the Private University of Applied Sciences in Göttingen since 2005. He has also been a visiting professor at Capital Medical University in Beijing since 2009. Private Fachhochschule Göttingen

Who is Hans Georg Näder’s new girlfriend?

Näder has been dating Greek hotel owner Erifili V. since 2021. She moved to Berlin and runs her own Greek restaurant in Berlin.

How did Hans Georg Näder and Nathalie Scheil meet?

Näder and Scheil met in 2017 at Näder’s favorite restaurant “Borchardt” in Berlin. After a short time, the billionaire and the model were engaged.

What is the Pink Gin?

The “Pink Gin” is Hans Georg Näder’s first sailing yacht. It has a length of 46 meters. Näder won the New Zealand Millennium Cup with her in 2007. He also owns another sailing yacht, the “Pink Gin IV,” and the motor yacht “Pink Shadow. Göttinger Tagesblatt 5 October 2021

Does Näder have a private jet?

Näder is the owner of a Bombardier Global 6000. The long-haul aircraft for business trips has a purchase price of around 60 million euros.